Ireland 2025 Gender Pay Gap Reporting: Navigating New Requirements

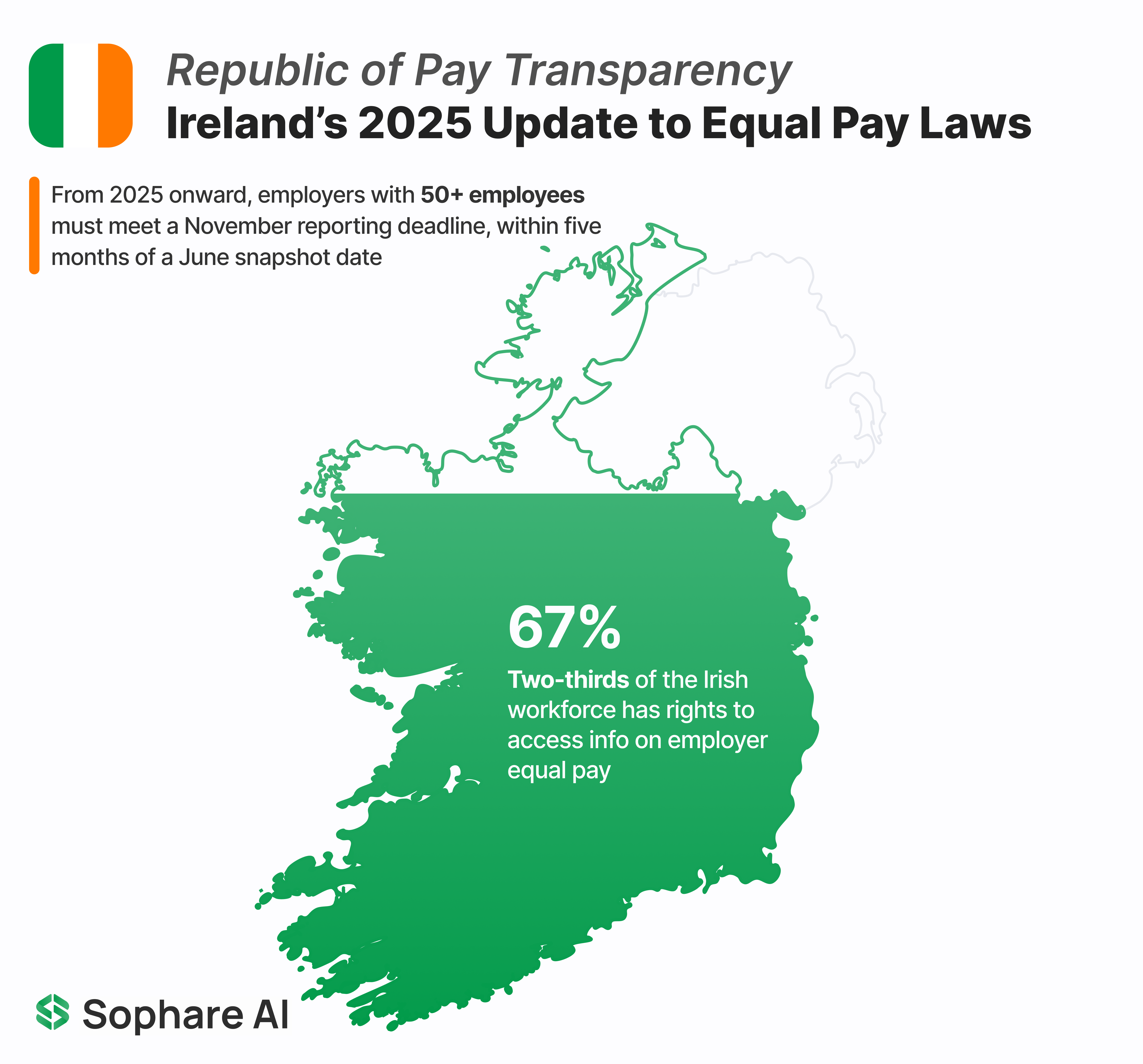

Ireland’s pay equity landscape is shifting quickly. The government’s campaign, “Highlight the difference to make a difference,” reflects a nationwide drive toward pay transparency. The Gender Pay Gap Information Act 2021 now extends to cover employers with 50 or more employees in 2025. HR leaders must understand new obligations and prepare teams ahead of the 2025 reporting cycle.

`

Official government resources have embraced the motto “Highlight the difference to make a difference!”

Sophare helps compensation and employment-legal teams keep track of regulatory changes so employers can focus on business continuity.

Lower thresholds and compressed timelines

The size of your workforce determines when your organisation must publish its gender pay gap report:

- 2022: 250+ employees

- 2024: 150+ employees

- 2025: 50+ employees

Employers must report within five months of their chosen snapshot date in June, moving the deadline from December → November. This expansion brings thousands of SMEs into scope and demands a proactive plan.

Why the 50-employee threshold matters

Companies employing 50 or more people represent roughly two-thirds of the Irish workforce. Bringing this cohort into the reporting regime increases coverage without overwhelming small employers. HR leaders should take stock of headcount ahead of the snapshot date. Organisations near the threshold should monitor growth to determine when reporting duties apply.

Larger employers often rely on tools like Sophare AI to track headcount and compliance obligations in real time, reducing the risk of missing key thresholds or deadlines.

10 steps for compliance

Official Irish government resources suggest this 10-step approach to meet compliance requirements:

- Choose a snapshot date in June 2025. The reporting deadline is 5 months after that date, in November 2025. The reporting period is the 12-month period immediately preceding and including the snapshot date

Snapshot date: 30 June 2025

Deadline: 30 Nov 2025

Reporting window: 30 Jun 2024 – 30 Jun 2025

- Calculate total headcount of relevant employees on the snapshot date

On the snapshot date:

- 2,308 full-time employees

- 186 part-time employees

- 87 employees are on leave:

- 38 employees are on career break (< 12 months)

- 8 have been on career break for over 12 months

- 29 employees are on paid parental leave

- 12 employees are on unpaid parental leave

- 18 employees are on the payroll but on secondment to 2 other organisations

The headcount on the snapshot date is 2,486 (2,308 + 186 = 2,494, less 8 on career break for over 12 months)

If the relevant headcount number is over 50, produce the following metrics for the report:

-

For each employee, calculate:

- total ordinary pay

- total bonus

- benefits-in-kind

- total working hours

- hourly remuneration

Keep track of employment status (full-time, part-time, temporary)

-

Calculate % of male and female employees paid bonuses

-

Calculate % of male and female employees receiving benefits-in-kind

-

Organise the employees into quartiles based on hourly remuneration of all male & female employees and calculate the proportions of male and female employees in each quartile

-

Calculate the mean hourly remuneration of male and of female employees, then calculate the gender pay gap in mean hourly remuneration of all employees. Do the same for male and female part-time employees and for male and female employees on temporary contracts

-

Calculate the median hourly remuneration of male and of female employees, then calculate the pay gap in median hourly remuneration of all employees. Do the same for male and female part-time employees and for male and female employees on temporary contracts

-

Calculate the mean bonus remuneration of male and of female employees, then calculate the pay gap in mean bonus remuneration of all employees

-

Calculate the median bonus remuneration of male and of female employees, then calculate the pay gap in median bonus remuneration of all employees

Selecting the right snapshot date and running calculations early leaves room for validation and narrative drafting. We recommend starting data analysis 2-3 months before your reporting deadline. Sophare has also helped clients complete compliant reports in under a week when timelines were tight.

Publication duties remain

Employers must publish their gender pay gap report on their website or, if no website exists, make the report accessible to the public in another way. There is no central regulator to file reports, so employers must ensure accessibility for employees and the public. Reports must remain publicly accessible for three years after publication. This means that in 2025, employers with 250 or more employees can begin lawfully taking down their first-year (2022) reports. Let this be a useful reminder to review your website archives and data-retention policy before removing any files.

In 2025, employers in Ireland who reported in 2022, can begin lawfully removing their first-year reports.

Consequences of non-compliance or late reporting

Failure to report can lead to a Workplace Relations Commission claim. The WRC can issue an order compelling compliance, and the Irish Human Rights and Equality Commission has the authority to seek enforcement through the Circuit Court or High Court. Beyond legal risk, non‑compliance can damage employee trust, engagement, and brand reputation in a climate where transparency is valued.

Use of AI in pay gap reporting

Sophare’s AI-native platform automates data gathering and cleaning, the slowest and most error-prone part of pay-equity analysis, and does the work in a fraction of the time and cost of legacy vendors like Syndio and Sysarb. Sophare has quietly become the leading pay transparency software in Europe and the US. Sophare’s founders developed and led pay equity programs as a data science initiative for Fortune 500 companies like Databricks and Salesforce for over a decade.

An AI-powered approach that monitors real-time changes to your workforce and plans in accordance with shifting global laws is a unique advantage Sophare offers to employers in and outside of Ireland.

Our systems monitor rule changes and update workflows automatically. Sophare’s interface is also built for employment legal teams, who are too often left out of HR tech software, even though much of pay transparency work is carried out under legal privilege.

Building momentum behind the movement

Ireland’s updated regulations signal broader European momentum toward pay transparency. Alongside government initiatives like Highlight the difference to make a difference, independent projects like Jennifer Keane’s paygap.ie are building a culture of accountability and open data. At first, transparency tools like Keane’s open the door to making complex reporting easily accessible and searchable. But with time, this new layer of transparency is fulfilling a much larger mission to empower citizens, journalists, and employers alike to take part in the story the data tells. Early adoption of rigorous reporting practices prepares organisations for upcoming EU-wide regulation, including the EU Pay Transparency Directive. HR leaders who embrace automation today will position their companies as employers of choice tomorrow.

FAQ: Ireland Gender Pay Gap Reporting

Who has to report under Ireland’s Gender Pay Gap rules?

Private and public sector employers above the legal employee threshold must publish an annual gender pay gap report covering a defined snapshot period. The threshold from 2025 onward is 50 employees.

What metrics are included in an Ireland gender pay gap report?

Reports include mean and median hourly pay gaps, mean and median bonus gaps, proportions receiving bonuses and benefits-in-kind, and pay distribution across quartiles. Employers also publish written explanations and actions to address gaps.

Do agency workers count in the figures?

For agency workers, the reporting liability falls on the agency employer (the entity that pays them) rather than the host company.

How are part-time and fixed-term employees treated?

Part-time staff are included. Hourly remuneration rates should reflect actual hours worked to allow like-for-like comparisons.

What counts as “bonus” in the Irish pay gap methodology?

Bonus covers incentive or variable pay in the snapshot year, including commission and cash allowances. Benefits-in-kind are reported separately as a participation metric.

Where and when do we have to publish?

Employers must publish the report on their website, or, if no website is available, make it otherwise publicly accessible. The report must be kept and remain available for three years.

Do we need an adjusted pay gap as well as the unadjusted gap?

Irish pay gap figures are unadjusted. Many employers also calculate an adjusted gap (controlling for job-related factors like role, level, tenure, and location) to understand drivers and to inform action plans. An adjusted pay gap will be required under the EU Pay Transparency Directive

What explanatory statement should we include?

Irish rules expect a narrative that explains the causes of your pay gaps and sets out targeted actions.

What are common pitfalls for Ireland reports?

Data quality issues (mis-grouped jobs, missing hours), unclear bonus definitions, not counting eligible populations, and thin or generic action plans. Build a clean data pipeline and review definitions against current guidance.